Unlock the Value of Your Home with a HELOC

There are many good reasons to own a home: more space, more control of your decorating and expansion, tax benefits. One of the best is that owning a home builds equity. By reliably paying your mortgage and investing in your home, you are literally living in four walls and a roof of equity.

A Home Equity Line of Credit (HELOC) from Allied Healthcare Federal Credit Union allows you to convert a portion of that equity into cash. If you bought your house for $100,000 a) congratulations to you on finding a steal on Southern California property and b) let’s say you paid $1000 a month for 60 months, you would have built $60,000 worth of equity in that home. Plus, in the 5 years you’ve been paying your mortgage, the value of your home has gone up which means your equity goes up too.

A HELOC is a way to open a line of credit with your home as the collateral. HELOCs provide various options to get the most value out of the equity you are already building every month.

Consolidate Your Bills

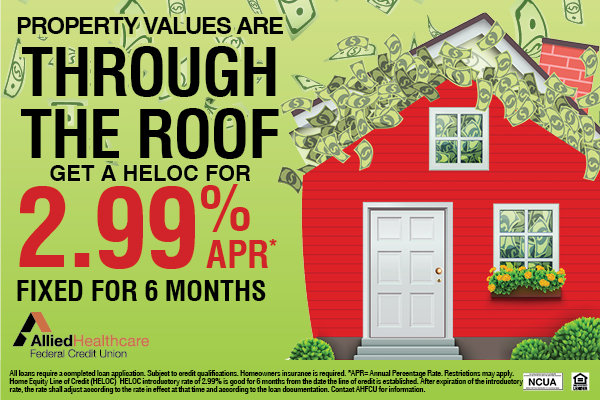

HELOCs have lower interest rates than other loans, especially credit cards. The average interest rates on HELOCs ranges from 3% to 12% but right now, Allied is offering HELOCs for 2.99% APR fixed for 6 months. At a rate like that, lower than the lowest range of the average and much lower than the average credit card rate (which is 16%, by the way) it makes sense to pay off other debts you might have to avoid paying undue interest.

If there are bills you get every month that seem to eat into your savings and sanity, HELOCs might be a way to turn those notes into a single note; paying off the low-interest HELOC.

Make Your Home Even More Valuable

A HELOC might be the perfect way to pay for a big-ticket item on your home like a kitchen remodel, new addition or house painting. Jobs like these often have large upfront costs so paying them off with a HELOC instead of financing with a contractor may be a way to save money while increasing the value of your home.

Retire Inspired

If you’re approaching retirement or already retired, a HELOC is a fine way to unlock cash flow. A HELOC can be used to pay for accessibility renovations or as down payments on rental properties.

A Word to the Financially Wise

HELOCs are great options for debt consolidation and renovations—or even for unexpected financial emergencies—but they aren’t the perfect financial tool for everything. With your home as collateral, the risks speak for themselves.

Many people use HELOCs as a way to finance college but we don’t recommend that. Federal student loans are made for that purpose and provide specific options, such as deferment or forgiveness, which HELOCs don’t offer.

You can use a HELOC for splashy personal items, from a new car to a dream vacation, but there are more prudent ways to achieve these items, from smart budgeting to specialized loans. Items like that are better suited by auto loans and personal loans which, luckily, are both offered by Allied.

HELOCs are simply another great resource to achieving your financial goals and at 2.99% fixed rate for 60 months, our HELOCs are another way Allied is committed to your financial healthcare for life. Home is where the heart is, but there’s also value there if you’re willing to unlock it. 60 seconds is all it takes to get started on a low-rate HELOC from Allied Federal Healthcare Credit Union.